Guide to buying property in Scotland: Step-by-Step Legal & Financial Process for 2025

Guide to buying property in Scotland is an exciting journey, but it requires careful planning and understanding of the country’s unique legal and financial systems. Whether you’re a first-time buyer, an experienced investor, or an international purchaser, knowing the process ensures you make informed decisions, avoid common pitfalls, and secure your ideal property with confidence. This guide to buying property in Scotland in 2025 provides a detailed roadmap to help you navigate finances, legal requirements, and practical considerations effectively.

Scotland’s property market offers a wide range of opportunities—from bustling city apartments in Edinburgh and Glasgow to rural estates and scenic coastal homes in the Highlands. Unlike England or Wales, Scotland has a distinct legal system, including home reports and missives, which buyers must understand before completing a purchase. Following this guide ensures a smooth, structured process, allowing you to achieve your property goals efficiently.

Understanding the Scottish Property Market

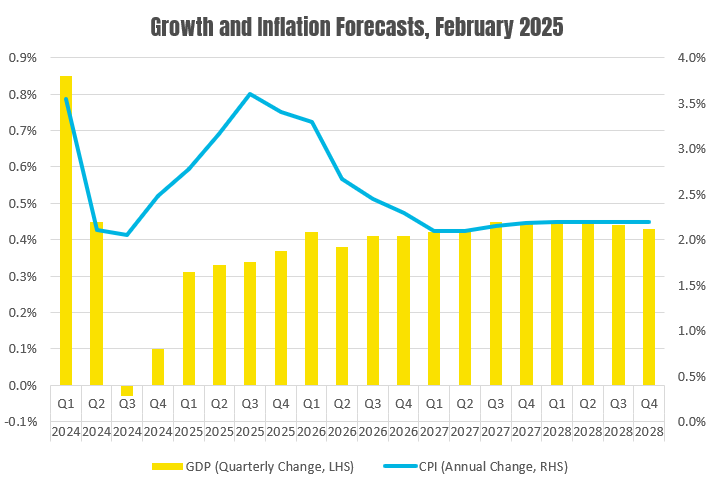

Scotland’s property market has grown increasingly diverse in 2025, offering options for urban professionals, retirees, and international buyers. Major cities such as Edinburgh and Glasgow provide vibrant cultural life and strong investment potential, while rural areas and coastal towns like Inverness, St Andrews, and Oban offer tranquil living with stunning landscapes.

Understanding local market trends is essential. Average property prices vary significantly between regions—Edinburgh’s city center apartments can range from £250,000 to £500,000, while Highland cottages might start at £150,000. Investors and first-time buyers alike benefit from being aware of these variations, as well as seasonal trends and demand patterns that can affect property value.

For international buyers or those familiar with overseas markets, Scotland offers a stable and transparent system compared to countries like Spain, Portugal, or Dubai. By understanding property regulations, market dynamics, and local investment returns, buyers can make confident decisions that ensure long-term financial security.

Financial Preparation and Mortgages

Before searching for a Guide to buying property in Scotland, it’s crucial to assess your finances. Buyers should budget not only for the purchase price but also for associated costs such as deposits, legal fees, taxes, surveys, and moving expenses. As of 2025, mortgage rates in Scotland range between 4% and 6% depending on loan-to-value ratios, type of mortgage, and credit history. Securing a mortgage in principle early strengthens your offer and clarifies borrowing limits.

Some buyers may consider Guide to buying property in Scotland purchasing through a limited company, which can provide tax advantages, flexibility for rental investments, and protection against personal liability. However, buying through a company also involves higher mortgage rates and additional legal responsibilities. Understanding all financial options—including cash purchases, shared ownership, or government schemes for first-time buyers—helps align your purchase with long-term goals.

Using tools such as mortgage calculators and affordability checkers can simplify planning. These tools allow you to estimate monthly payments, total costs, and the impact of interest rates, ensuring you’re financially prepared before making an offer.

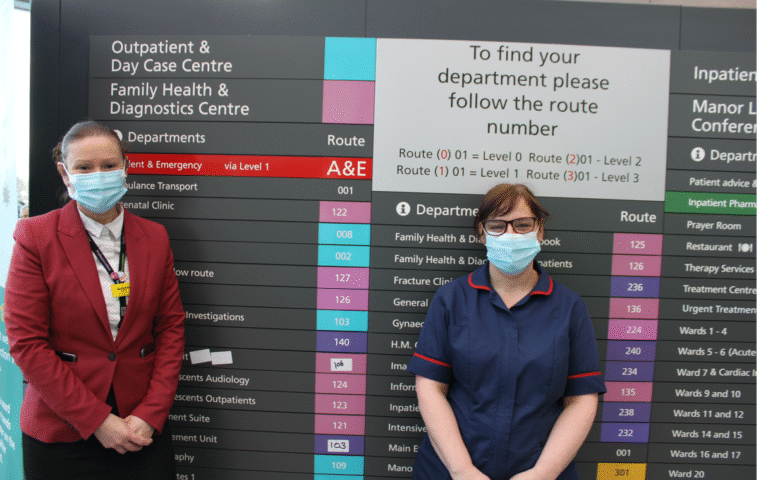

Legal Process and Hiring a Solicitor

Hiring a qualified Scottish Guide to buying property in Scotland is essential. Scottish law differs significantly from England and Wales, and navigating contracts, timelines, and legal obligations requires expertise. Solicitors handle tasks such as reviewing the home report, lodging notes of interest, negotiating missives, and completing legal formalities.

The home report is a key document in Guide to buying property in Scotland, providing information on property condition, market valuation, and energy efficiency. Buyers should review it carefully, considering potential repairs and long-term maintenance costs. Solicitors also Guide to buying property in Scotland buyers through missives, which are legally binding letters forming the contract between buyer and seller. Understanding these documents prevents costly mistakes and protects your investment.

International buyers and investors benefit from legal guidance to ensure compliance with UK regulations. Solicitors can clarify additional taxes, stamp duty implications, and residency requirements, ensuring the process runs smoothly and avoids delays.

Step-by-Step Guide to Buying Property in Scotland

Step 1: Research and Property Search

Begin by researching locations, property types, amenities, and prices. Online listings, local estate agents, and property portals provide insights into market trends. Visiting multiple properties helps gauge value and assess potential issues, ensuring a well-informed decision.

Step 2: Financing and Mortgage Pre-Approval

Determine your budget and secure a mortgage in principle if applicable. Pre-approval not only clarifies your borrowing capacity but also strengthens your negotiating position. Consider fees, taxes, and other purchase-related costs when calculating your total budget.

Step 3: Reviewing the Home Report

The home report includes a property survey, energy report, and valuation. Assess structural integrity, necessary repairs, and energy efficiency. This document forms the basis for negotiation and ensures transparency in the purchase.

Step 4: Making an Offer and Exchanging Missives

Submit your offer and negotiate terms through your solicitor. Once agreed, missives are exchanged, creating a legally binding contract. Understanding timelines, contingencies, and obligations is vital to avoid delays or disputes.

Step 5: Completion and Moving In

On completion day, funds are transferred, and ownership legally changes hands. Arrange utilities, insurance, and moving logistics in advance to ensure a smooth transition into your new Scottish property.

Common Pitfalls and Risks

Buying Guide to buying property in Scotland presents risks that buyers must anticipate. Common pitfalls include:

- Underestimating additional costs: Taxes, legal fees, and surveys can significantly add to expenses.

- Skipping home inspections: Failing to review the home report carefully can lead to unexpected repairs.

- Legal misunderstandings: Ignoring obligations in missives or contracts can create disputes.

Investors and international buyers should also consider differences between Scottish and overseas markets. Legal systems, tax implications, and financing options vary widely, and awareness is essential to avoid financial loss. Planning carefully, seeking professional advice, and understanding local regulations reduces risks and ensures a successful purchase.

Additional Tips for International Buyers

- Visa and Residency Requirements: Check UK and Scottish immigration rules if planning to live in or rent out the property.

- Tax Considerations: International buyers may face additional taxes on rental income or capital gains. Consulting a tax professional is highly recommended.

- Property Management Services: For remote investors, hiring local property management can simplify maintenance, tenant management, and compliance with regulations.

FAQs

1. What is the legal process for buying property in Scotland?

The process involves reviewing the home report, negotiating missives through a solicitor, and completing legal formalities for transfer of ownership.

2. Can foreigners buy property in Scotland?

Yes, international buyers can purchase property, but additional taxes and residency considerations may apply.

3. How much deposit is required for a property in Scotland?

Deposits typically range from 5% to 20% of the property price, depending on mortgage terms and financial circumstances.

4. Is it beneficial to buy property through a limited company in the UK?

It can offer tax advantages and investment flexibility, but comes with higher mortgage rates and added legal responsibilities.

5. What are common pitfalls when buying property abroad?

Misunderstanding legal obligations, underestimating costs, and skipping inspections can lead to financial loss.

6. How does the Scottish property market differ from England and Wales?

Scotland has a distinct legal system, including home reports and missives, and property transactions follow unique timelines.

7. Can I buy property in Scotland with cash?

Yes, cash purchases simplify the process by eliminating mortgage arrangements, but legal fees and taxes still apply.

8. Are there additional taxes for international buyers in Scotland?

Yes, non-residents may face higher stamp duty rates or additional taxes on rental income.

9. What government schemes exist for first-time buyers in Scotland in 2025?

Schemes like the First Home Fund and Help to Buy Scotland assist eligible buyers with deposits and low-interest mortgages.

Conclusion

Purchasing a property in Scotland in 2025 requires careful planning, up-to-date knowledge, and professional guidance. By understanding the legal system, financial considerations, and market trends, buyers can navigate the process confidently, avoid pitfalls, and secure their ideal property. Using this comprehensive guide ensures each stage—from research to completion—is managed effectively, providing a smooth, successful property-buying experience.

You may also read: Waterfront properties UK for Sale: Your Ultimate Guide to Luxury Homes by the Water