UK Mortgage Rates Comparison: Find the Best Deals & Save on Your Mortgage Today

Understanding UK mortgage rates comparison rates is essential for anyone planning to buy a home, remortgage, or invest in property. With constantly shifting interest rates and a wide range of lenders offering diverse deals, a comprehensive UK mortgage rates comparison can help borrowers make informed decisions. By comparing rates, you can secure the most suitable mortgage, minimise monthly repayments, and potentially save thousands over the lifetime of your loan.

A thorough comparison is particularly important for first-time buyers, remortgagers, and buy-to-let investors. The UK mortgage market is complex, with many products, terms, and fees influencing the total cost. Comparing rates ensures that borrowers choose the mortgage best suited to their financial circumstances and long-term goals, avoiding overpaying and securing competitive deals.

Understanding UK Mortgage Rates

Mortgage rates in the UK differ depending on the type of mortgage you choose. Fixed-rate mortgages provide predictable repayments, ensuring your monthly payments remain consistent for a set period. Variable or tracker mortgages fluctuate with the Bank of England base rate, which can offer lower initial payments but carries some risk if rates rise.

Several factors influence mortgage rates, including loan-to-value (LTV) ratios, lender fees, and the broader economic environment. Conducting a UK mortgage rates comparison allows borrowers to assess these variables and choose a mortgage type that matches their risk tolerance and budget.

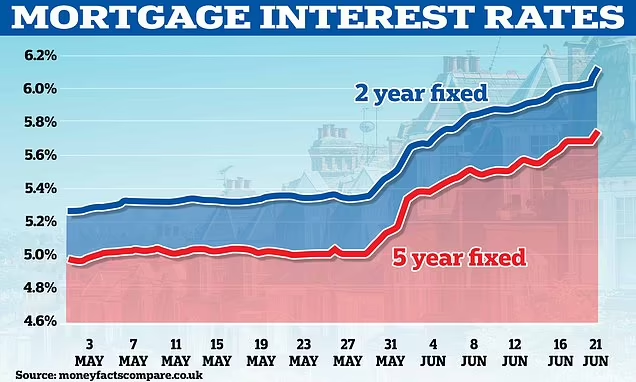

Using mortgage rate charts, online comparison tools, and market data can help borrowers understand the bigger picture, including historical trends and current conditions. This insight can guide strategic decisions, such as whether to lock in a rate now or wait for potential future reductions.

Key Factors Affecting Mortgage Rates

When comparing UK mortgage rates, it’s crucial to consider the factors that directly influence them:

- Loan-to-Value (LTV) Ratio: A higher deposit usually results in lower rates. Borrowers with lower LTV ratios often access the most competitive deals.

- Credit Score: Lenders assess your credit history to determine your risk profile. A higher score can secure better rates.

- Economic Conditions: Bank of England base rate changes, inflation, and overall economic stability impact mortgage rates.

- Mortgage Fees: Arrangement fees, valuation fees, and early repayment charges can affect the true cost of a mortgage.

A detailed UK mortgage rates comparison accounts for all these factors, helping you make decisions that reflect both the rate and total cost over the term of the loan.

Comparing Major UK Lenders

The UK mortgage market is competitive, with banks and building societies offering a wide range of products. A thorough mortgage rates comparison highlights key differences among lenders such as Barclays, HSBC, NatWest, Nationwide, Santander, and Halifax.

It’s not just about finding the lowest rate—evaluating lender fees, special offers, and repayment flexibility is equally important. Some lenders provide incentives like free valuations or cashback for first-time buyers, while others may have stricter eligibility criteria. Comparing multiple lenders ensures you select a mortgage that aligns with your financial goals and risk tolerance.

Specialised Mortgage Options

Not all mortgages are standard. Specialist options often require careful comparison:

- First-Time Buyer Mortgages: Designed for those purchasing their first home, often with lower deposits or government-backed schemes.

- Remortgages: Switching to a lower-rate deal can reduce monthly payments and total interest.

- Buy-to-Let Mortgages: For landlords, these mortgages differ in interest rates, fees, and eligibility.

- Government-Backed Schemes: Products like Help to Buy, First Homes, or Shared Ownership require a tailored approach to ensure you get the best deal.

A dedicated UK mortgage rates comparison helps borrowers navigate these options, identifying the most suitable and cost-effective solutions.

Trends and Predictions in Mortgage Rates

Staying updated with mortgage trends is essential. The Bank of England base rate currently stands at 3.75%, influencing most fixed, tracker, and variable mortgages in the UK. Analysts and brokers often provide forecasts to help borrowers plan. For example, recent reductions in base rates have created opportunities to secure lower rates for remortgaging or moving home.

By regularly monitoring trends, borrowers can make strategic choices, such as locking in a rate during a dip or choosing a variable mortgage when rates are high but expected to fall. Understanding market shifts and government policy decisions ensures informed, financially advantageous choices.

Tips for Securing the Best Mortgage Deal

Finding the right mortgage involves more than selecting the lowest interest rate. Key considerations include:

- Fees and Charges: Factor in arrangement fees, valuation costs, and early repayment penalties.

- Flexibility: Consider offset options or products that allow overpayments.

- Deposit Size: Larger deposits often unlock better rates.

- Professional Advice: Mortgage brokers can provide access to exclusive deals and simplify the application process.

Using online comparison tools and mortgage calculators can help visualise potential repayments and total costs over the loan term. Regularly reviewing rates ensures access to the most competitive deals across the UK.

Understanding Mortgage Calculators

Mortgage calculators are invaluable when comparing deals. They help estimate:

- Monthly Repayments: Based on loan amount, interest rate, and term.

- Borrowing Capacity: Evaluates how much you can realistically borrow given income and outgoings.

- LTV Impact: Shows how deposit size affects rates and repayments.

These tools allow borrowers to model scenarios, making decisions based on data rather than guesswork. While calculators don’t guarantee approval, they provide a clear starting point for planning and comparison.

The Role of Mortgage Brokers

Mortgage brokers simplify the process of securing a competitive mortgage. They can:

- Access exclusive deals not available directly from lenders

- Evaluate your financial situation to recommend suitable options

- Assist with paperwork, saving time and reducing stress

Regulated by the FCA, brokers provide professional advice that can improve your chances of finding the right mortgage quickly and efficiently.

Common Mortgage Fees and Terms

Understanding fees and key terms is essential:

- Arrangement Fee: Charged by lenders to set up the mortgage.

- Early Repayment Charge (ERC): A penalty for paying off a mortgage early.

- APRC: Annual Percentage Rate of Charge includes interest and fees, giving a full picture of cost.

- LTV: Loan-to-value ratio, a measure of deposit versus property price.

Being aware of these elements allows borrowers to accurately compare deals, ensuring the total cost aligns with their budget and financial goals.

Conclusion

A comprehensive UK mortgage rates comparison empowers borrowers to make informed decisions in a complex market. By evaluating lender rates, fees, and specialised products, and by keeping track of market trends, homeowners, first-time buyers, and investors can secure deals that reduce financial risk and maximise savings.

Consistently reviewing mortgage options, utilising calculators, and seeking professional advice ensures you access competitive rates tailored to your financial circumstances. Taking the time to compare today could save thousands over the life of your mortgage, ensuring your investment is smart and sustainable.

You may also read: Savills: Expertise in Luxury and Investment