UK Real Estate Market Forecast 2025: Key Price Trends, Growth Outlook & Investment Insights

The UK real estate market forecast 2025 points to a year of stabilisation rather than rapid expansion, marking an important transition period after several volatile years. Following the economic strain of 2023 and 2024, characterised by elevated interest rates, inflation pressures, and subdued buyer confidence, the property market is expected to move into a more balanced phase. This shift reflects a market adjusting to new financial realities rather than chasing the aggressive growth patterns of the past.

Most industry forecasts indicate UK property prices could rise between 1% and 4% in 2025, depending on region, property type, and economic conditions. While this growth range may appear modest, it signals recovery and resilience rather than stagnation. A slower pace allows affordability to stabilise and supports healthier long-term demand across residential and investment segments.

For buyers, sellers, landlords, and investors, 2025 is shaping up to be a year where strategy matters more than speed. Understanding regional differences, financing conditions, and structural market trends will be critical for making informed property decisions.

UK Real Estate Market Forecast 2025: Core Predictions

The UK real estate market forecast 2025 suggests the return of more rational pricing after years of correction. Rather than dramatic rebounds, analysts expect steady and sustainable appreciation driven by improving mortgage conditions, stable employment, and controlled inflation. This environment reduces speculative risk while favouring long-term ownership and income-driven investment strategies.

One of the most significant changes compared to previous years is the shift away from demand fueled by ultra-low interest rates. Instead, 2025 growth will be supported by fundamentals such as household formation, housing supply shortages, and gradual wage growth. This recalibration may limit short-term gains but strengthens market resilience.

Another defining feature of 2025 is improved market transparency. Buyers are better informed, sellers are more realistic on pricing, and lenders are applying stricter affordability checks. These factors collectively support a more mature property cycle that rewards careful planning rather than aggressive speculation.

House Price Trends Across the UK

Regional divergence remains a dominant theme in the UK real estate market forecast 2025. London and the South East are expected to maintain price stability and modest growth due to constrained supply, global demand, and strong employment hubs. However, affordability pressures may limit rapid appreciation, particularly in prime urban locations.

In contrast, regional cities such as Manchester, Birmingham, Leeds, and Liverpool continue to benefit from regeneration projects, population growth, and expanding rental demand. These markets are increasingly attractive to both domestic and overseas investors seeking better yields and lower entry prices compared to London.

Property type also plays a significant role in price performance. Family homes in suburban and commuter locations remain in demand, supported by flexible working trends and lifestyle-driven relocations. Meanwhile, city-centre flats may experience slower growth due to service charge costs, changing tenant preferences, and oversupply in certain developments.

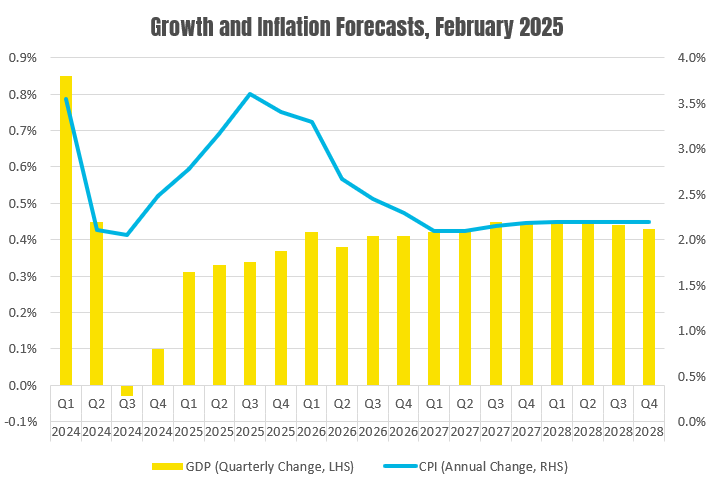

Interest Rates, Inflation, and Mortgage Conditions

Interest rates are a central driver of the UK real estate market forecast 2025. While rates are expected to decline gradually, they are unlikely to return to the ultra-low levels seen before 2022. This means borrowing will remain more expensive than in previous cycles, directly influencing affordability and purchasing power.

For mortgage holders, 2025 will be a year of adjustment. Many borrowers refinancing from fixed-rate deals will face higher repayments, even with modest rate cuts. This dynamic may cap price growth in certain areas, particularly where incomes have not kept pace with housing costs.

Inflation easing is a positive signal, as it supports real wage growth and improves household budgets. As confidence slowly returns, buyer activity is expected to strengthen in the second half of 2025, provided rate reductions are delivered as anticipated.

Housing Supply and Demand Imbalance

A persistent undersupply of housing continues to shape the UK real estate market forecast 2025. Planning constraints, rising construction costs, and labour shortages have limited new housing delivery across many regions. This structural imbalance provides long-term support for prices, even in slower growth conditions.

Demand remains strongest in areas offering employment opportunities, transport connectivity, and quality-of-life advantages. Urban regeneration zones and commuter towns linked to major cities are particularly well-positioned to attract sustained interest from buyers and renters alike.

Government housing initiatives may influence supply at the margins, but meaningful relief is unlikely in the short term. As a result, competition for well-located and energy-efficient properties is expected to remain strong throughout 2025.

Investment Outlook: Opportunities and Risks

From an investment perspective, the UK real estate market forecast 2025 favours income-focused strategies over short-term capital gains. Rental demand remains robust due to affordability constraints, higher mortgage costs, and lifestyle flexibility among tenants. This supports steady rental yields across key regional markets.

Buy-to-let investors are increasingly selective, prioritising locations with strong employment bases and limited rental stock. Cities with universities, healthcare hubs, and infrastructure investment are particularly attractive due to consistent tenant demand.

However, investors must also navigate regulatory changes, tax considerations, and evolving energy efficiency standards. Properties requiring significant upgrades may face downward pressure on valuations, while energy-efficient homes could command premium rents and stronger long-term returns.

Commercial and Mixed-Use Property Trends

Commercial real estate continues to adapt in the UK real estate market forecast 2025. Office demand remains selective, with emphasis on high-quality, flexible spaces that support hybrid working. Older stock without sustainability upgrades may struggle, while modern developments in core locations retain value.

Logistics and industrial assets remain among the most resilient segments, driven by e-commerce, supply chain restructuring, and last-mile delivery demand. These assets offer defensive characteristics in uncertain economic conditions.

Mixed-use developments combining residential, retail, and workspace elements are gaining traction as cities focus on regeneration and community-driven planning. These projects align with long-term urban development strategies and appeal to both occupiers and investors.

Government Policy and Regulatory Environment

Government policy will continue to influence the UK real estate market forecast 2025, particularly through taxation, planning reform, and housing incentives. Adjustments to stamp duty thresholds or first-time buyer schemes could impact transaction volumes and entry-level demand.

Political stability plays a critical role in maintaining international investor confidence. The UK remains an attractive destination for global capital due to its legal framework, transparent property rights, and established financial system.

Environmental regulations are also becoming more influential. Minimum energy efficiency standards are reshaping investment decisions and property valuations, making sustainability a central consideration for future-proofing assets.

Market Sentiment and Transaction Activity

Transaction volumes in 2025 are expected to improve modestly compared to 2024 but remain below long-term averages. Early-year caution is likely as buyers wait for clearer signals on interest rates and economic momentum. Activity is expected to strengthen later in the year as confidence improves.

Seller behaviour has also evolved. Pricing expectations are more realistic, and properties priced correctly are achieving faster sales. This adjustment supports smoother transactions and reduces the risk of prolonged market stagnation.

Overall sentiment is improving, but remains cautious. Buyers and investors are more analytical, prioritising value, resilience, and long-term fundamentals over rapid appreciation.

Outlook Beyond 2025

Looking beyond the UK real estate market forecast 2025, the medium-term outlook remains constructive. As inflation stabilises and borrowing costs ease further, pent-up demand may re-enter the market, supporting stronger growth from 2026 onwards.

Structural trends such as urban regeneration, demographic shifts, and sustainability-driven development are expected to shape future demand. Regions aligned with these trends are likely to outperform over the next property cycle.

Long-term success in the UK property market will depend on adaptability. Investors and homeowners who understand evolving preferences, regulatory changes, and economic signals will be best positioned to capture future opportunities.

Conclusion

The UK real estate market forecast 2025 highlights a year of recalibration rather than rapid growth. While price increases are expected to remain modest, the return of stability represents a healthier foundation for the market. Buyers gain improved negotiating power, investors benefit from stronger rental fundamentals, and long-term planning becomes more predictable.

For those willing to focus on fundamentals rather than short-term speculation, 2025 offers meaningful opportunities. Strategic location selection, financial discipline, and awareness of broader economic trends will be essential in navigating a market that continues to evolve.

FAQs

Will UK house prices increase in 2025?

Yes, forecasts suggest modest growth of around 1% to 4%, varying by region and property type.

Which UK regions offer the best investment potential in 2025?

Regional cities with strong employment growth and rental demand, such as Manchester and Birmingham, continue to attract investor interest.

How will interest rates affect the housing market in 2025?

Gradual rate reductions should improve affordability, but borrowing costs will remain higher than pre-2022 levels.

Is 2025 a good year to buy property in the UK?

For long-term buyers, 2025 offers improved price stability and less competition compared to previous years.

What are the biggest risks facing the UK property market?

Economic uncertainty, regulatory changes, and slower-than-expected rate cuts remain the main risks.

You may also read: Student accommodation investment UK: Complete 2025 Guide to Profitable Opportunities