BT Share Price Today: Live Chart, News, Dividends & How It Compares to Top UK and Global Stocks

The BT share price is a key indicator for investors seeking insights into the UK telecom market. BT Group plc, headquartered in London, operates across fixed-line, broadband, mobile, and IT services, making it one of the UK’s most prominent telecom companies. Tracking the BT share price allows investors to assess market trends, understand company performance, and make informed decisions. Regular monitoring of BT share price helps compare it with other major stocks such as Vodafone, Rolls Royce, Tesco, and HSBC.

Understanding the BT share price also provides insight into investor sentiment and broader market conditions. Price movements reflect both company-specific news and general economic factors, including regulatory changes, technological developments, and competitor strategies. By evaluating the BT share price alongside other prominent stocks like Tesla, BP, and Shell, investors can make strategic decisions based on relative performance, dividend yields, and growth potential.

BT Share Price Overview

The current BT share price provides a snapshot of the company’s market value. Trading on the London Stock Exchange under the ticker BT.A, BT share price is closely monitored by investors for daily fluctuations and long-term trends. Factors affecting BT share price include trading volume, market sentiment, and investor confidence. By tracking BT share price, shareholders gain insight into the company’s performance and potential for future returns.

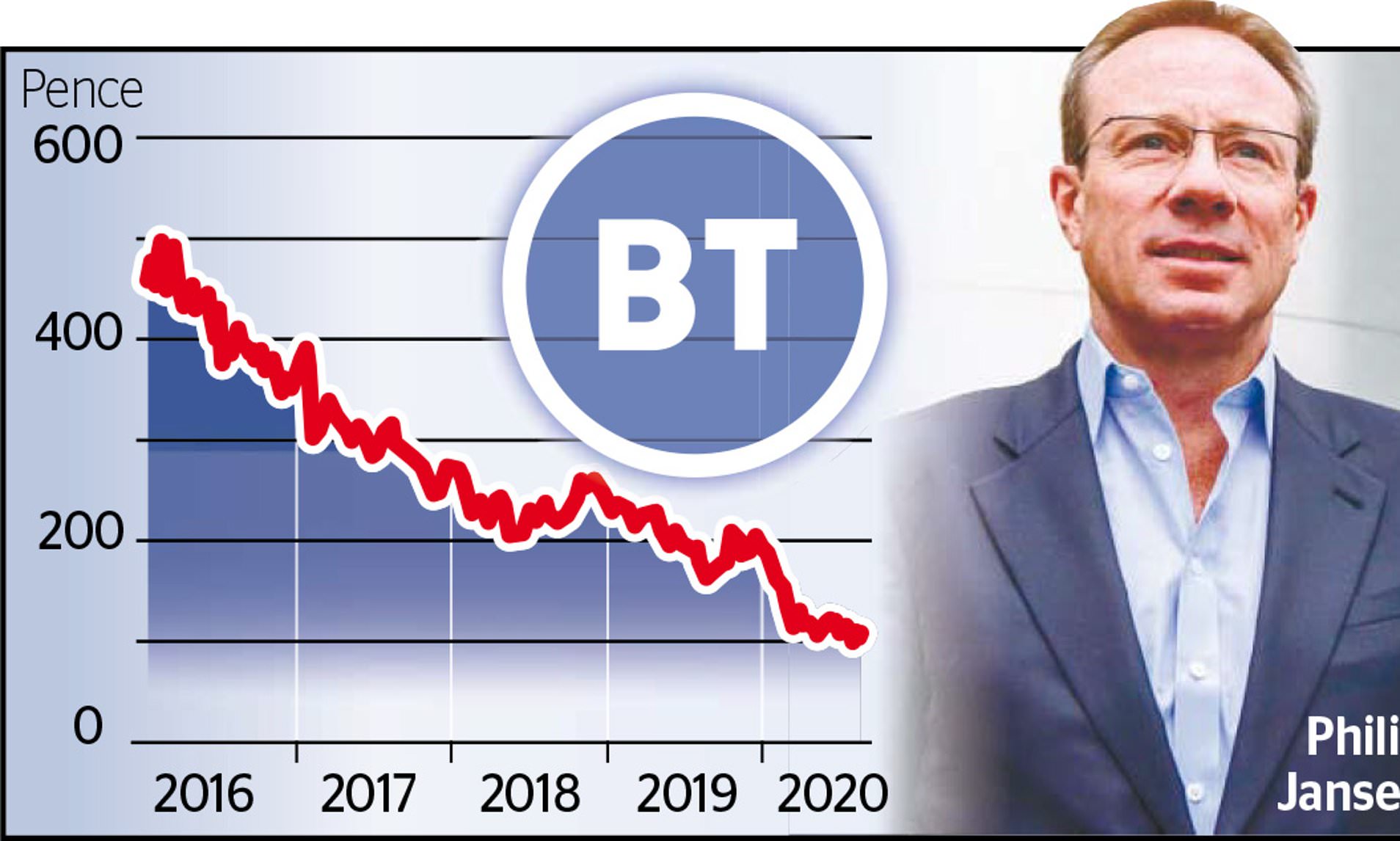

Historically, BT share price has experienced periods of volatility, influenced by financial reports, dividend announcements, and global market conditions. Investors often look at the 52-week high and low of BT share price to gauge stability and risk. Comparing BT share price with competitors such as Vodafone, Lloyds, and Rolls Royce allows investors to evaluate performance within the telecom and broader UK market. Historical BT share price charts also highlight trends that inform trading strategies.

BT Dividends and Financials

BT share price is closely linked to the company’s dividend payments. Regular dividends enhance the attractiveness of BT share price for income-focused investors. BT has a consistent history of quarterly dividends, which can support long-term share price stability. Understanding BT share price alongside dividend yield is essential for evaluating the stock’s total return potential.

Financial performance directly impacts BT share price movements. Metrics such as quarterly revenue, net income, earnings per share, and profit margins provide insight into the company’s financial health. Investors often compare BT share price with other UK financial giants like HSBC, Barclays, and Aviva to assess relative stability and growth prospects. Monitoring BT share price in conjunction with financial statements helps make informed investment decisions.

Factors Influencing BT Share Price

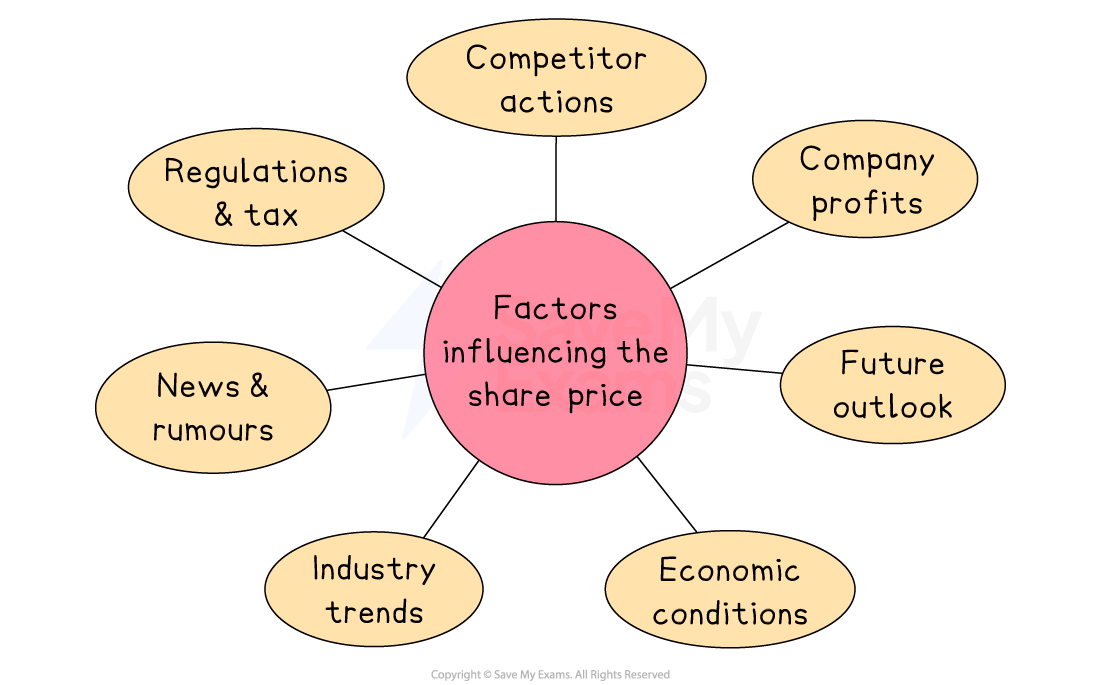

The BT share price is influenced by a mix of internal and external factors. Market trends, technological innovations, and regulatory changes can all impact BT share price. For example, advancements in broadband or mobile networks may boost investor confidence, while regulatory restrictions could negatively affect BT share price. Keeping track of these elements is crucial for predicting short-term and long-term movements.

Competitor performance also plays a key role in BT share price dynamics. Stocks like Vodafone, Tesco, Rolls Royce, and BAE can influence investor perception and market comparisons. Global economic conditions, such as energy prices and inflation, also affect BT share price. By monitoring these factors, investors gain a more comprehensive understanding of BT share price trends and potential risks.

BT Share Price vs Competitors

Comparing BT share price with other leading UK and international stocks helps investors evaluate performance. BT share price can be compared to Lloyds share price, Tesco share price, Tesla share price, and BP share price to understand market positioning and growth potential. Such comparisons provide context for investment decisions and highlight the strengths and weaknesses of BT share price relative to peers.

Sector-specific comparisons also offer valuable insight into BT share price. For example, BT share price versus Vodafone share price highlights telecom industry trends, while BT share price versus Nvidia share price or Shell share price reflects broader market dynamics. Investors can use BT share price alongside competitor analysis to make informed portfolio choices. Understanding these comparisons allows investors to identify opportunities and mitigate risks effectively.

BT Share Price Forecast and Expert Opinions

Forecasting BT share price involves analysing historical data, market trends, and company strategies. Experts provide projections for short-term and long-term BT share price performance, helping investors make informed decisions. Factors such as earnings growth, dividend sustainability, and sector performance influence BT share price forecasts. By considering these forecasts, investors can anticipate potential movements in BT share price.

Analyst opinions also play a significant role in shaping BT share price sentiment. Ratings like buy, sell, or hold can affect investor behaviour and drive market activity. Monitoring BT share price alongside forecasts for other major stocks such as EasyJet share price, Shell share price, and GSK share price provides a broader perspective. Expert insights help investors evaluate BT share price in the context of the wider market.

How to Invest in BT Shares

Investing in BT shares requires understanding market conditions and monitoring BT share price. Shares can be purchased through UK brokers or online trading platforms, with attention to fees, market hours, and liquidity. Knowing the BT share price at the time of investment ensures informed entry points and risk management.

Consistent tracking of BT share price is essential for successful investing. Comparing BT share price trends with other companies like Vodafone share price, Tesco share price, and BP share price allows investors to refine strategies and identify opportunities. Researching BT share price history, news, and forecasts enhances decision-making and improves the potential for profitable outcomes.

Conclusion

The BT share price remains a vital metric for investors in the UK telecom sector. Understanding BT share price trends, financial performance, and dividend history allows investors to make informed choices. Comparing BT share price with leading UK and global stocks provides perspective on market positioning and growth potential. Regular monitoring of BT share price ensures investors remain proactive in a dynamic market, maximising opportunities and managing risks.

You may also read: guia silent hill geekzilla: Silent Hill 2 and Remake