Best UK Cities for Property Investment: A Practical Guide for Buy-to-Let and Long-Term Growth 2026

Property investment in the UK remains one of the most reliable ways to build long-term wealth when decisions are based on fundamentals rather than hype. While market conditions have shifted over the past two years, rental demand across major UK cities continues to rise due to housing shortages, population growth, and lifestyle changes that favour renting. As a result, investors who choose the right locations can still achieve sustainable returns.

This updated guide explains the best UK cities for property investment based on rental demand, affordability, economic resilience, and long-term growth potential. Instead of chasing headlines, the focus here is on where investment logic still makes sense today, and how different cities suit different investor goals.

Why UK Property Investment Still Makes Sense Today

Despite higher borrowing costs compared with previous years, the UK property market remains structurally strong. Demand for rental homes continues to exceed supply in most cities, driven by a growing population, delayed home ownership, and increased mobility among workers and students. This imbalance supports rental income even during slower price-growth periods.

Another reason property investment remains attractive is stability. The UK offers a transparent legal system, established landlord regulations, and unrestricted access for international buyers. When combined with careful location selection and realistic financial planning, property investment in the UK continues to offer a balance of income security and long-term capital appreciation.

What Actually Makes a City Good for Property Investment

Not every popular city is a good investment city. Successful investors look beyond reputation and focus on factors that directly influence returns. Rental demand is the foundation — cities with universities, large employers, hospitals, and transport hubs consistently attract tenants. Without demand, even cheap property becomes a liability.

Equally important is affordability in relation to rents. Cities where purchase prices remain realistic compared to local incomes often produce healthier yields and lower risk. Long-term growth is usually supported by regeneration, infrastructure upgrades, and job creation rather than short-term price spikes. The best UK cities for property investment combine demand, affordability, and economic momentum.

Manchester: Strong Demand and Broad Investor Appeal

Manchester continues to perform well because it offers something many investors look for — depth. The city has a diverse economy, large graduate retention, and a constant flow of professionals, students, and relocators. This creates year-round rental demand across multiple property types, from city-centre apartments to suburban family homes.

From an investment perspective, Manchester suits those seeking balance rather than extremes. Rental yields are supported by demand, while long-term growth is underpinned by continued business expansion and regeneration. Investors who focus on tenant quality, transport access, and realistic pricing tend to see consistent performance over time.

Liverpool: High Yields with Ongoing Regeneration

Liverpool stands out for investors who prioritise rental income. Property prices remain relatively accessible, while rental demand is supported by universities, healthcare institutions, and a growing professional population. This combination allows investors to achieve stronger yields compared with many southern cities.

Regeneration has played a major role in Liverpool’s improvement, but sensible investors avoid speculative buying and focus instead on areas with proven tenant demand. When approached carefully, Liverpool can provide reliable cash flow alongside gradual capital growth, making it suitable for income-focused buy-to-let strategies.

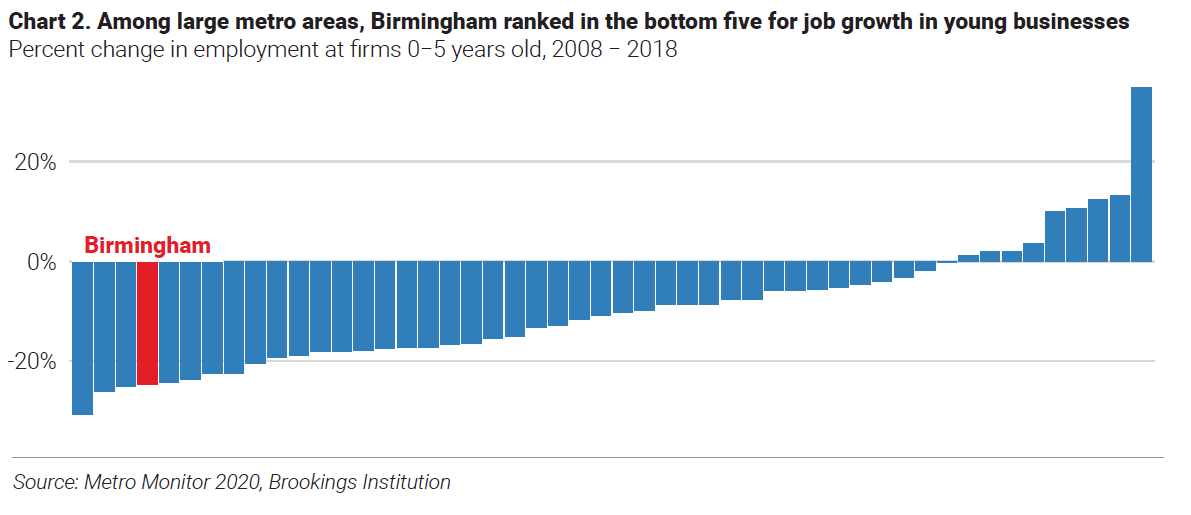

Birmingham: Long-Term Growth and Market Stability

Birmingham appeals to investors who value long-term fundamentals over short-term yield chasing. As one of the UK’s largest employment centres, the city benefits from population growth, transport connectivity, and a broad tenant base that includes professionals, families, and students.

Property investment in Birmingham is often about patience. Rental income is steady rather than exceptional, but long-term growth prospects are supported by regeneration and economic expansion. Investors who plan carefully and focus on sustainable rent levels tend to find Birmingham a dependable addition to a long-term portfolio.

Leeds: Professional Tenants and Consistent Demand

Leeds has built a reputation as a stable investment city, particularly for landlords targeting working professionals. The city’s strong presence in finance, healthcare, education, and digital sectors supports consistent rental demand across different economic cycles.

Leeds suits investors who want reliability rather than volatility. While property prices have increased steadily, they remain more accessible than many southern cities. When combined with a strong tenant pool and improving infrastructure, Leeds continues to justify its position among the best UK cities for property investment.

Glasgow: Affordability and Income-Focused Returns

Glasgow remains attractive for investors seeking affordability and rental income. As Scotland’s largest city, it benefits from a large student population, a strong public sector presence, and ongoing urban renewal. These factors contribute to resilient rental demand even during market slowdowns.

While capital growth in Glasgow tends to be steadier rather than rapid, income-focused investors often find the city appealing. Careful property selection and awareness of local regulations are essential, but Glasgow continues to offer value in a market where affordability is increasingly rare.

London: Capital Growth over Cash Flow

London operates differently from the rest of the UK property market. Rental yields are typically lower, but demand remains constant due to the city’s global status, employment opportunities, and international appeal. Investors in London often prioritise long-term capital growth rather than immediate income.

In today’s market, many investors focus on outer areas and well-connected zones where affordability is improving. London can still play a role in a diversified portfolio, particularly for investors seeking asset security and long-term appreciation rather than short-term yield.

High-Yield Cities vs Long-Term Growth Cities

Understanding the difference between yield-driven and growth-driven cities is essential. Northern and Scottish cities often deliver stronger rental yields due to lower purchase prices, while southern cities tend to offer slower but steadier capital appreciation.

A balanced approach may involve combining income-focused cities such as Liverpool or Glasgow with growth-oriented markets like Birmingham or London. This diversification helps investors manage risk while benefiting from different market dynamics.

Common Mistakes Investors Make When Choosing Cities

One of the most common mistakes is chasing headline yields without understanding tenant demand. High advertised returns often come with higher risk if the area lacks stable employment or reliable renters. Another mistake is overpaying in newly promoted “hotspots” without proven rental performance.

Successful investors focus on fundamentals rather than marketing. They assess who will rent the property, how long demand is likely to last, and whether the numbers still work under conservative assumptions. Avoiding emotional decisions is key to long-term success.

How to Choose the Right City for Your Investment Goals

The best UK city for property investment depends on personal objectives. Investors seeking monthly income may prioritise affordability and yield, while those focused on wealth preservation may prefer long-term growth markets. Understanding financing, risk tolerance, and management capacity is essential before choosing a location.

Research, patience, and realistic expectations remain the most valuable tools. Cities that combine demand, affordability, and economic resilience tend to outperform over time, even when market conditions change.

Conclusion

The best UK cities for property investment in today’s market are those supported by real demand, economic strength, and long-term fundamentals. Manchester, Liverpool, Birmingham, Leeds, Glasgow, and London each offer different advantages depending on investment strategy and risk appetite.

Property investment in the UK is not about finding a perfect city, but about matching the right city to the right strategy. Investors who focus on value, sustainability, and long-term thinking are best positioned to succeed in the years ahead.

FAQs

Which UK city offers the best rental yields today?

Cities with lower entry prices and strong tenant demand, particularly in the North and Scotland, often deliver higher rental yields than southern markets.

Is buy-to-let still viable in the UK?

Yes, when properties are purchased at sensible prices and aligned with genuine rental demand.

Should I invest in London or regional cities?

This depends on goals. London suits long-term growth strategies, while regional cities often provide better income returns.

What is more important: yield or capital growth?

Neither is universally better. Many investors aim for a balance by diversifying across different UK cities.

Can overseas investors buy property in the UK?

Yes, the UK remains one of the most accessible property markets for international investors.

You may also read: Ben and Jerry’s Cookie Dough Ice Cream: The Ultimate Guide to Flavours, Recipes & Where to Buy in the UK