Stamp Duty Calculator UK – Calculate Your 2025/26 Stamp Duty with Confidence

Buying a property in the UK involves more than agreeing on a purchase price. One of the most important costs to understand early is Stamp Duty Land Tax. A reliable stamp duty calculator UK allows buyers to estimate this cost instantly, helping them plan their finances accurately before making an offer.

This guide explains how stamp duty works in England and Northern Ireland, how to use a stamp duty calculator UK correctly, and how different buyer situations affect the final amount. Whether you are a first-time buyer, moving home, or purchasing an additional property, this article is designed to give you clarity, accuracy, and confidence for 2025 and beyond.

How a Stamp Duty Calculator UK Works

A stamp duty calculator UK estimates how much tax you will need to pay based on your purchase details. Instead of applying one flat percentage, stamp duty is calculated in stages, with different portions of the property price taxed at different rates. A calculator applies these bands automatically, saving time and avoiding costly mistakes.

To get an accurate result, a calculator needs the correct information. This usually includes the property price, your buyer status, and whether the property is located in England or Northern Ireland. Advanced calculators also consider whether the purchase is an additional property or if any buyer is classed as non-UK resident for tax purposes. The more accurate the inputs, the more reliable the estimate.

Understanding Stamp Duty in the UK

Stamp duty is a tax charged when buying property above certain thresholds. In England and Northern Ireland, this tax is officially called Stamp Duty Land Tax, often shortened to SDLT. The amount payable depends on how much you pay for the property and your personal buying situation.

It is important to note that stamp duty is not applied across the whole UK in the same way. Scotland and Wales operate their own property taxes with different rules and bands. A well-designed stamp duty calculator UK should make this distinction clear so buyers do not apply the wrong rates to their purchase.

Stamp Duty Rates for England and Northern Ireland in 2025/26

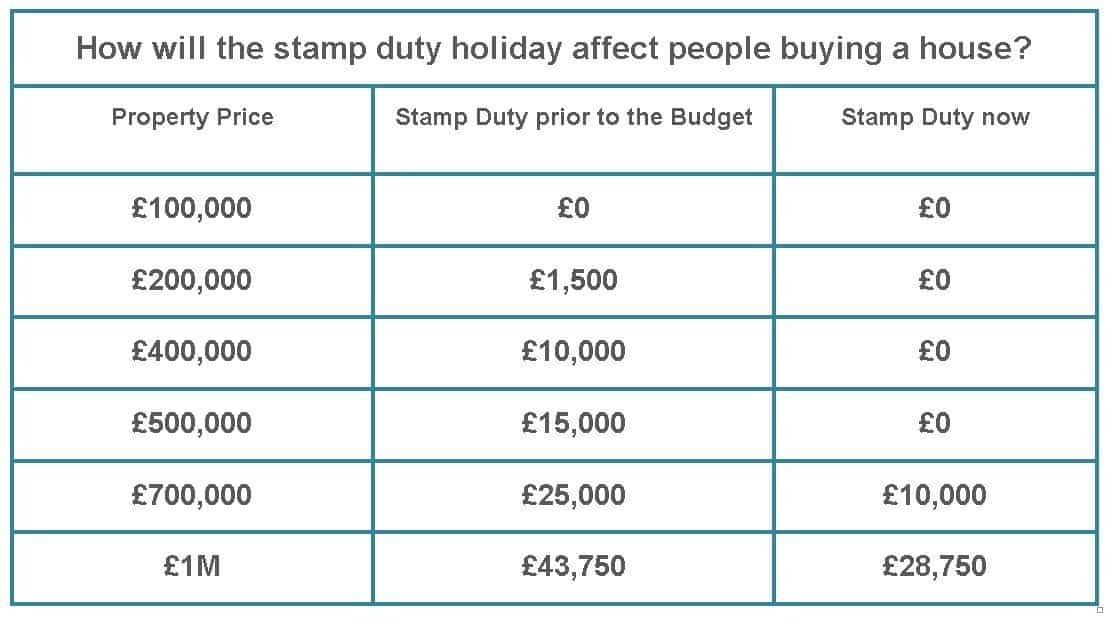

For most buyers purchasing a main residence in England or Northern Ireland, stamp duty is calculated using progressive bands. This means you only pay each rate on the portion of the price that falls within that band, not on the full value of the property.

For example, if you buy a property for £300,000, part of the price may be taxed at 0 percent, part at 2 percent, and part at 5 percent. A stamp duty calculator UK applies this automatically and shows a clear breakdown, helping buyers understand where the final figure comes from and why.

Using a Stamp Duty Calculator UK Before Making an Offer

Many buyers wait until late in the buying process to calculate stamp duty, which can lead to unpleasant surprises. Using a stamp duty calculator UK early allows you to see the true cost of a property and decide whether it fits your budget.

This is especially useful when comparing multiple properties at slightly different prices. A small increase in purchase price can sometimes push part of the value into a higher tax band, increasing the stamp duty due. A calculator helps buyers factor this into negotiations and make informed decisions from the start.

Stamp Duty for First-Time Buyers

First-time buyers often benefit from reduced stamp duty, making it easier to get onto the property ladder. A stamp duty calculator UK designed for first-time buyers shows how much tax is reduced or removed based on current relief rules.

Eligibility usually depends on whether all buyers involved have never owned a property before. If even one buyer has previously owned a home, first-time buyer relief may not apply. A clear calculator result helps avoid misunderstandings and ensures buyers budget correctly from the outset.

Stamp Duty When Moving Home

Home movers buying a new main residence typically pay stamp duty at standard residential rates. However, the situation can become more complex if the previous home has not yet been sold on completion day.

A stamp duty calculator UK can still provide an estimate, but buyers should be aware that owning two properties at the point of completion may trigger higher rates temporarily. Understanding this in advance helps buyers prepare for short-term costs and plan any potential refunds correctly.

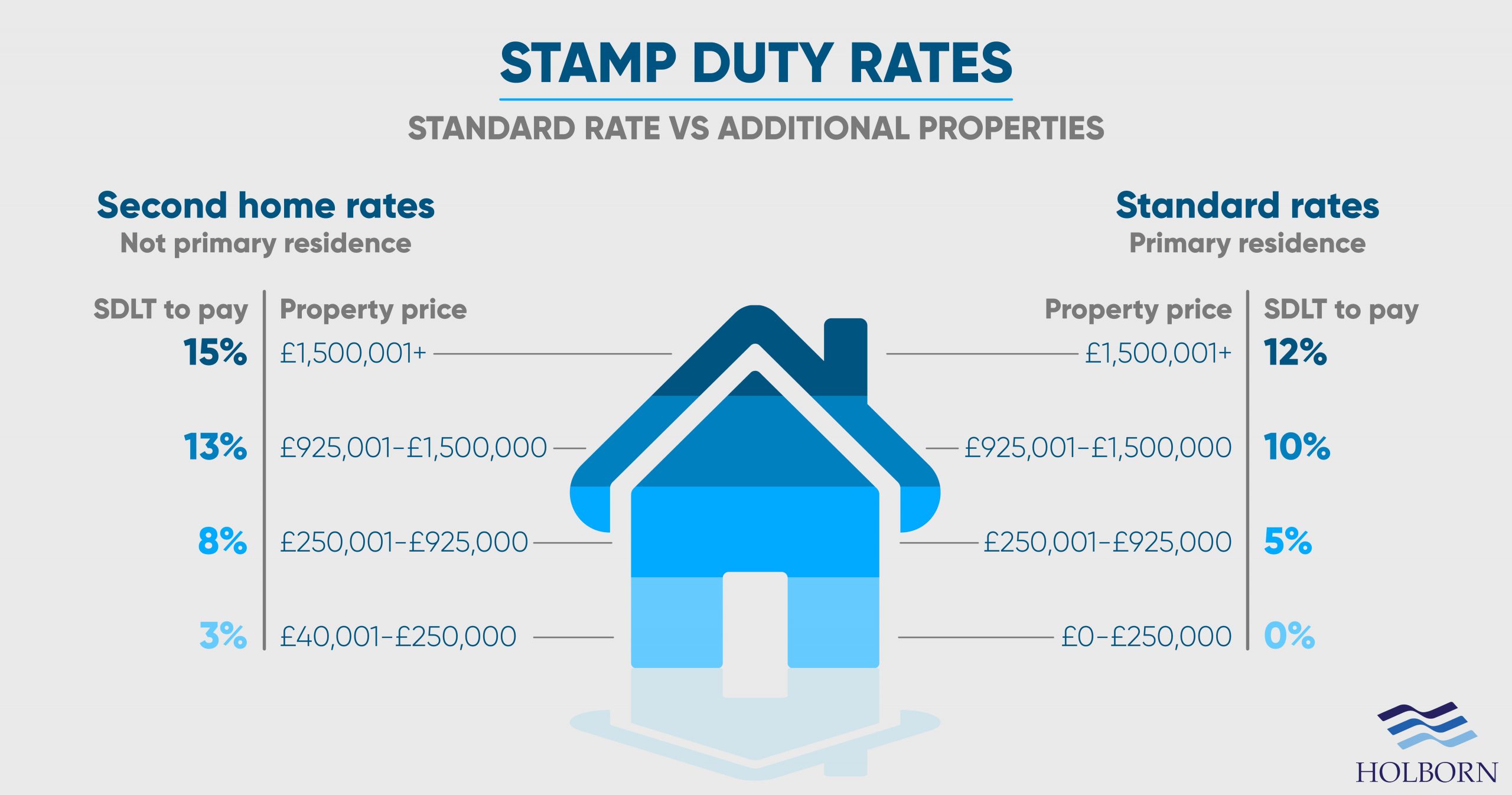

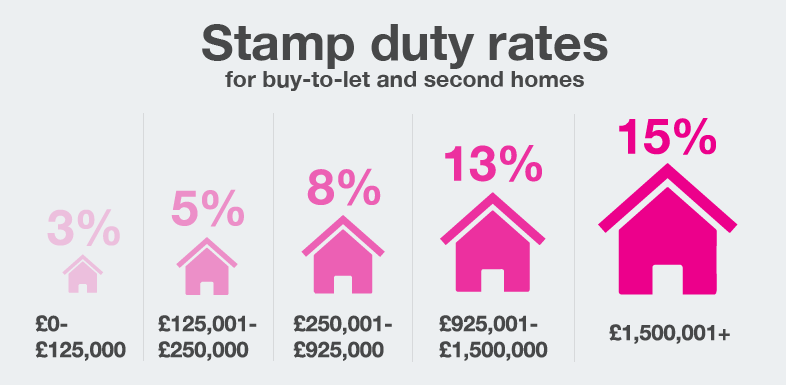

Buy-to-Let and Second Homes

Buying a second home or a rental property usually results in higher stamp duty. These higher rates significantly increase the total tax due and can have a major impact on overall investment returns.

A stamp duty calculator UK that includes an “additional property” option is essential for investors. It allows buyers to see the full cost before committing and compare potential purchases accurately. This is particularly important when calculating yields, mortgage affordability, and long-term profitability.

Replacing a Main Residence and Refunds

In some situations, buyers may pay higher stamp duty when purchasing a new home before selling their old one. This does not always mean the extra tax is permanent. If the previous main residence is sold within the allowed timeframe, a refund of the higher portion may be available.

While a stamp duty calculator UK cannot process refunds, it can help buyers understand the initial amount due and identify whether they may be eligible to reclaim part of the tax later. This knowledge can significantly reduce financial stress during a move.

Stamp Duty for Non-UK Residents

Stamp duty rules can differ if a buyer is classed as non-UK resident for tax purposes. In these cases, an additional surcharge may apply, increasing the total tax payable.

A good stamp duty calculator UK highlights this possibility and encourages buyers to check their residency status carefully. Even British citizens living abroad may fall into this category depending on how much time they have spent in the UK before purchasing a property.

Scotland and Wales: Important Differences

Although many people search for a stamp duty calculator UK, buyers in Scotland and Wales do not pay SDLT. Scotland uses Land and Buildings Transaction Tax, while Wales applies Land Transaction Tax.

The rates, thresholds, and reliefs in these regions are different. For accuracy, buyers should always use a calculator specifically designed for the country where the property is located. Clear guidance on this point helps prevent costly miscalculations and improves user trust.

When Stamp Duty Must Be Paid

Stamp duty is not paid gradually over time. It is due shortly after the property purchase is completed. In most cases, payment and paperwork are handled by a solicitor or conveyancer as part of the buying process.

Understanding the payment deadline is important, as late payment can result in penalties or interest. A stamp duty calculator UK helps buyers plan for this cost in advance so funds are available when needed.

Common Mistakes Buyers Make with Stamp Duty

One of the most common mistakes is assuming stamp duty applies as a single percentage to the whole purchase price. This misunderstanding often leads to over- or under-estimating costs. A calculator avoids this by applying each band correctly.

Another frequent issue is forgetting to account for buyer type. First-time buyers, home movers, and investors are all treated differently. Using a stamp duty calculator UK that reflects your exact situation prevents inaccurate budgeting and last-minute surprises.

Why an Updated Stamp Duty Calculator UK Matters

Stamp duty rules can change, sometimes with little notice. Using outdated rates or thresholds can result in incorrect estimates that disrupt financial planning. An up-to-date stamp duty calculator UK reflects the latest rules and ensures calculations are based on current information.

For buyers in 2025 and beyond, this is especially important as thresholds and surcharges have changed in recent years. Accurate, current information builds confidence and supports smarter buying decisions.

FAQs

What is stamp duty in the UK?

Stamp duty is a tax paid when buying property above certain thresholds. In England and Northern Ireland, it is called Stamp Duty Land Tax and is calculated in bands rather than as a single rate.

How accurate is a stamp duty calculator UK?

A stamp duty calculator UK provides an estimate based on the information entered. It is highly accurate for standard purchases, but complex situations may require professional advice.

Do first-time buyers always pay stamp duty?

Not always. Many first-time buyers pay reduced or no stamp duty depending on the purchase price and eligibility. A calculator shows whether relief applies in your case.

Is stamp duty the same across the UK?

No. England and Northern Ireland use SDLT, while Scotland and Wales have different systems with different rates. Always use the correct calculator for your location.

Final Thoughts

A stamp duty calculator UK is one of the most useful tools available to property buyers. It turns a complex tax system into a clear, manageable figure that can be factored into budgets, negotiations, and long-term planning.

By using an up-to-date calculator and understanding how stamp duty works for your specific situation, you reduce uncertainty and make more confident property decisions. Whether you are buying your first home, moving house, or investing in property, accurate stamp duty estimates are an essential part of the process.

You may also read: Pricing and valuation strategies